Are you wondering whether or not a self-insured health plan is the right option for your business?

As a business owner or HR professional, we know you want to offer your employees a strong employee benefits package.

This includes an excellent group health insurance plan.

In order for you to continue offering excellent health insurance, you may need to think about making plan design changes.

Here’s a plan design strategy we’ve advised employers on.

Ultimately, it helps them gain more control over their group health insurance, and at the same time, reduce the risk of rising health insurance costs.

What is a Self-Insured Health Insurance Plan?

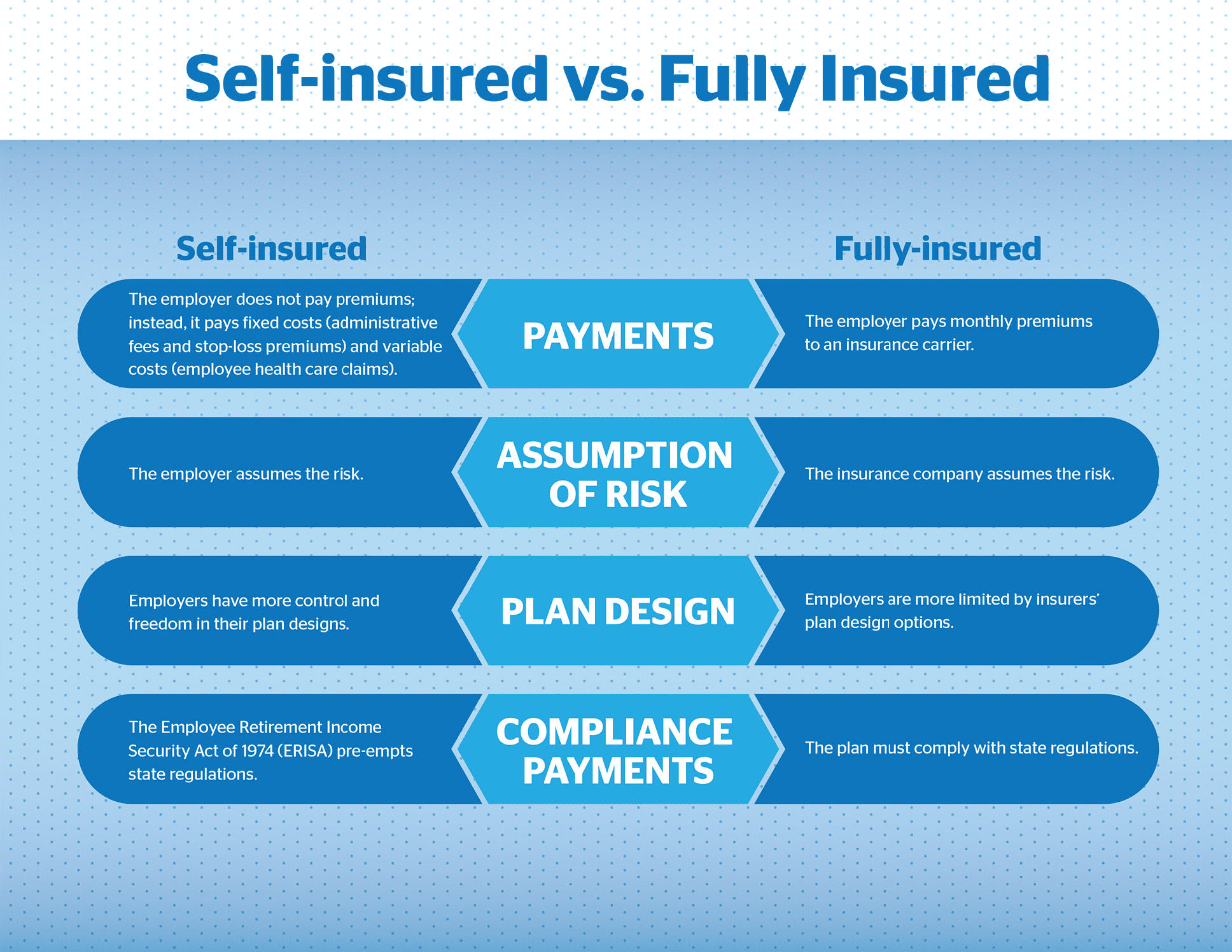

In a self-insured health insurance plan, you as the employer assume the financial risk associated with providing health care benefits to your employees.

So, rather than paying fixed premiums to an insurance company – which, in turn, assumes the financial risk of paying health insurance claims – the employer pays for medical claims out-of-pocket as they are incurred.

According to the Kaiser Family Foundation (KFF) and the Health Research and Educational Trust’s (HRET) Employer Health Benefits 2018 Annual Survey, 61% of covered workers are in a self-insured health plan.

Of these covered workers, 13% are workers in small firms and 81% are in large firms. Generally speaking, as the number of workers in a firm increases, the percentage of covered workers in a self-insured plan increases.

Experts believe this is because large firms can spread the risk of costly, large claims or unexpectedly high expenses over a larger pool of workers and dependents.

These trends are on par with what the market has seen in the past few years.

With a self-insured health plan, employers operate their own health plan as opposed to purchasing a fully-insured plan from an insurance carrier.

Why Should an Employer Consider A Self-Insured Health Insurance Model?

A self-insured plan allows employers to save the profit margin that an insurance company adds to its premium for a fully insured plan.

So, an employer has more control over the plan design and gains access to claims data – which can help employers determine how to design a group health insurance plan to meet the healthcare needs of their specific employee population.

However, self-insuring can expose your company to much larger risk in the event that more claims than expected must be paid.

Fixed Costs and Variable Costs in Self-Insured Health Plans

There are two main costs to consider a self-insured health plan: fixed costs and variable cots.

The fixed costs include administrative fees, any stop-loss premiums and any other set fees charged per employee. These costs are generally billed monthly by the third-party administrator (TPA) or the carrier handling plan administration, and are charged based on plan enrollment.

The variable costs include payment of health care claims. These costs vary from month to month based on health care use by covered persons (that is, employees and dependents).

Limit Financial Risk with a Stop-Loss Insurance Policy

To limit risk, some employers purchase a stop-loss insurance policy which reimburses the employer for claims that exceed a predetermined level.

This coverage can be purchased to cover any catastrophic claims on one covered person (specific coverage) or to cover claims that significantly exceed the expected level for the group of covered persons (aggregate coverage).

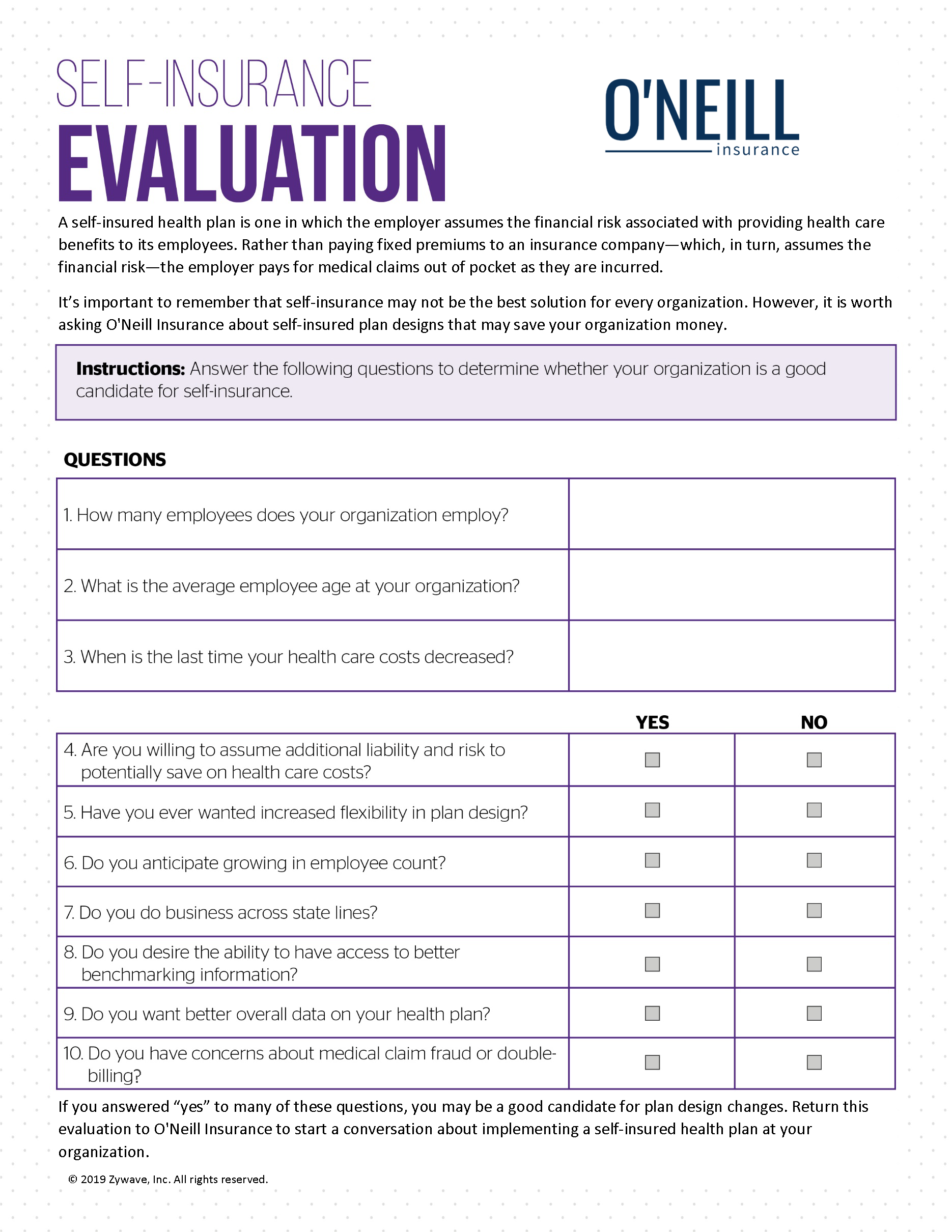

Use our Evaluation Form to Determine if Self-Insurance is Right For Your Company.

Here’s the Pros of Self-Insured Health Plans:

Here’s the Pros of Self-Insured Health Plans:

- Reduced insurance overhead costs: Carriers assess a risk charge for insured policies (approximately 2% annually), but self-insurance removes this charge.

- Employer control: Employers who want to revise covered benefits and the levels of coverage are free from state regulations that mandate coverage and the carrier negotiation typically required with charges in insured coverage. By self-funding, employers are able to design their own customized health benefit packages.

- Employers see improved cash flow since they do not have to prepay for coverage: Claims are paid as they become due. There is also a cash flow advantage in the year of adoption when “run out” claims are being covered by the prior insurance policy. Employers pay for the claims rather than premiums and earn interest income on any unclaimed reserves.

- Choice of claim administrator: An insured policy can be administered only by the insurance carrier. A self-insured plan can be administered by the company, an insurance company or independent TPA, which gives the employer greater choice and flexibility. When selecting a TPA, employers should consider whether the TPA efficiently handles claims; has contacts with stop-loss carriers; has a strong reputation, cost management skills and negotiating clout; has medical expertise on staff; and provides excellent customer service and claims administration.

Note: Talk to an attorney for self-insured health plan specifics related to your state. This guide is intended for informational use only and uses general statements.

Here’s the Cons of Self-Insured Health Plans:

While self-insuring can have its advantages, it can be a lengthy process for employers, and it can sometimes be a long time before they see results.

Here’s a list of potential disadvantages to self-insuring.

- Greater risk: The main risks of self-insuring involve situations when claims are higher than anticipated. While stop-loss coverage will protect employers from paying excessive claims in a given year, the cost of that coverage will likely increase, and it may be more difficult to get rates from other stop-loss providers. Claims that are higher than expected in a self-insured plan may also make it more difficult for employers to go back to a fully insured plan in the future. And, an employer’s assets may be exposed to liability as a result of any legal action taken against the plan. Legal matters in regards to self-insured plans can be complex.

- Higher administrative costs: For organizations that choose to run their self-insured plans internally, the administrative costs involved can be significant. However, using TPAs to operate the plans will still likely involve lower administrative costs than those associated with fully insured plans.

Deciding if a Self-Insured Health Plan Model is Right For You?

When deciding if self-funding is right for your company, make sure you consider the following best practices to ensure that your self-insured strategy is appropriate and effective.

- Evaluate stop-loss coverage. Most self-insured employers purchase stop-loss insurance on their self-insured health care benefit plans to reduce the risk of large individual claims or high claims for the entire plan. The employer self-insures claims up to the stop-loss attachment point, which is the dollar amount above which claims will be reimbursed by the stop-loss carrier. Obtain stop-loss quotes at several different levels.

- Understand the volume and nature of your employee health claims for the past five years. Knowing facts such as the average age of your workforce, whether the majority of claims were due to chronic illnesses or one-time incidents, and the total dollar amount of claims will help you budget for claims in the future. Self-funding should be viewed as a long-term strategy in which good and bad years average out in the employer’s favor.

- Analyze cash flow. Self-insured plans work best for companies that have a strong cash flow or reserves. Understand what your cash needs are so you have money available to make timely claim payments.

- Decide whether it makes sense to administer the plan internally or through a TPA. If you decide that it’s best for your organization to use a TPA, make sure you factor TPA fees into your decision to self-insure. Obtain several different TPA quotes. Your TPA should offer a strong strategy for monitoring the plan.

- Make coverage goals. Decide on such things as eligibility, benefit coverage, exclusions, cost sharing, policy limits and retiree benefits. Weigh the self-insured plan advantages of flexibility and lower average cost versus the increased risk and administrative responsibilities.

Because the employer assumes the financial risk of providing health care benefits, a company can either save or lose money depending on the level of claims incurred by its employees.

The most important step you can take to assure you’re making the best decision is to have an experienced professional assist you.

Is Self-Insured a Fit for You?

At this point, if you see value in determining whether a self-insured group benefits plan is a fit for you, let’s talk.

After our call, if you don’t want to move forward, that’s fine too.

Worst case is that you receive free advice from a licensed Benefits advisor which will help you make more informed decisions on your benefits plan.

Ultimately, this is for executives who are ready to take more control over their company’s healthcare costs, and they understand the opportunities a self-insured group benefits plan can present to your company’s bottom line.

If that’s you, today is the day you take action and get the information you need to see if your company is ready to move self-insured.

Click the button below to request a free consultation from a licensed Benefits Advisor, Ty Reid.

Here’s the

Here’s the